IndiaFirst Life Introduces One-of-Its-Kind ‘Saral Bachat Bima’ Pla

A Non-Linked, Non-Participating, Individual, Limited Premium, Savings Life Insurance Policy that provides shorter pay commitment to ensure protection and safety to the entire family

Key Highlights:

· Pay for a shorter period and enjoy long-term benefits

· Constant protection for family’s future through Insurance Cover

· Additional Sum Assured, in case of Accidental Death during the 1st policy year only

· In case of life assured’s death, get an advanced payout through Funeral Cover

· Boost savings with Guaranteed Additional Benefits of 4.75% to 6% annually

· Flexibility to receive death benefit as lump sum or regular income for 5 years

· Option to opt for Waiver of Premium Rider

· No medical tests and shortened application form – a simple and seamless process

Mumbai: Life Insurance Company Limited (IndiaFirst Life), promoted by Bank of Baroda and Union Bank of India, today introduced IndiaFirst Life Saral Bachat Bima Plan, a savings and protection cover for the entire family. This non-linked, non-participating, individual, limited premium policy provides a shorter pay commitment of five or seven years while keeping you and your entire family protected for 12 or 15 years.

IndiaFirst Life Saral Bachat Bima Plan is a competitively priced plan that helps in saving for your future financial needs. It secures your family’s future in case of an unfortunate event. Furthermore, it offers yearly guaranteed additions, additional accidental death benefit in 1st year, funeral cover along with no medical tests, and quick processing all under one roof. Safeguarding the family’s investment needs wisely, the plan provides Sum Assured on Maturity plus accrued guaranteed additions on the date of maturity. Tax benefits can be availed as per prevailing Income Tax Laws.

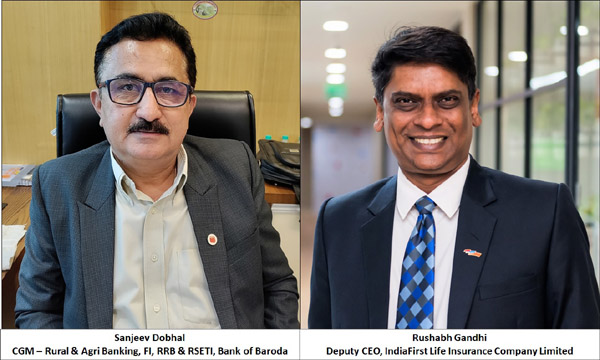

Rushabh Gandhi, Deputy CEO, IndiaFirst Life Insurance Company Limited said, “In line with our #CustomerFirst ideology, we are delighted to launch IndiaFirst Life Saral Bachat Bima Plan. This bespoke simplified product offers dual benefit of protection and savings. It is primarily designed for customers of the Regional Rural Banks (RRBs) and rural branches who prefer simple and easy to comprehend products that can be availed through a “Saral” hassle-free process.”

Sanjeev Dobhal, CGM – Rural & Agri Banking, FI, RRB & RSETI, Bank of Baroda, said, “I’m delighted that our partner IndiaFirst Life has created a hyper-personalized and easy to understand product that caters to the specific need of our rural / RRB customers. They can buy the product through a simplified OTC process, which takes care of their safety, security, and monetary needs. I’m confident that through IndiaFirst Life Saral Bachat Bima Plan, the RRB business will grow exponentially.”

IndiaFirst Life offers a diversified suite of 45 need-based (products & riders) offerings catering to varied customer segments, leveraging multiple distribution capabilities, and augmenting various investment options. We service customers across 98% pin-codes in the country through our diversified distribution network.